This guide accompanies the video where I walk through 30 outbound plays and the thinking behind when each one works, when it does not, and how to prioritise them.

If you have spent any time on LinkedIn in January 2026, you have probably seen a spike in posts about signal-based prospecting. Like most trends in sales and marketing tech, it can get sold as a silver bullet. The reality is that only a small percentage of your total addressable market will surface clean, usable signals at any given time.

Signals are still valuable. The right way to use them is as a prioritisation layer for your reps, not as your entire outbound strategy.

The Big Idea: Signals Are for Prioritisation

Most of your market will not show obvious signals. That means a good outbound programme needs three lanes running together:

- Signal-based plays (demand capture)

- Problem x persona plays (demand generation)

- Marketing-driven plays (excuses to reach out)

In practice, you will run a mix of all three. Signals help you decide where to apply more manual effort, more personalisation, and faster speed-to-lead. The rest of the market still needs a smart, segmented, volume-based approach.

Foundations You Need Before Any Plays Will Work

Before you worry about signals or clever plays, make sure the fundamentals are in place. Without these, even the best signals will underperform.

- A clear Ideal Customer Profile (ICP)

- Clear buyer personas (roles, responsibilities, pains, triggers)

- A strong understanding of the problems you solve

- Messaging that resonates with your ICP and personas

- Access to the right data sources (and a way to enrich and activate the data)

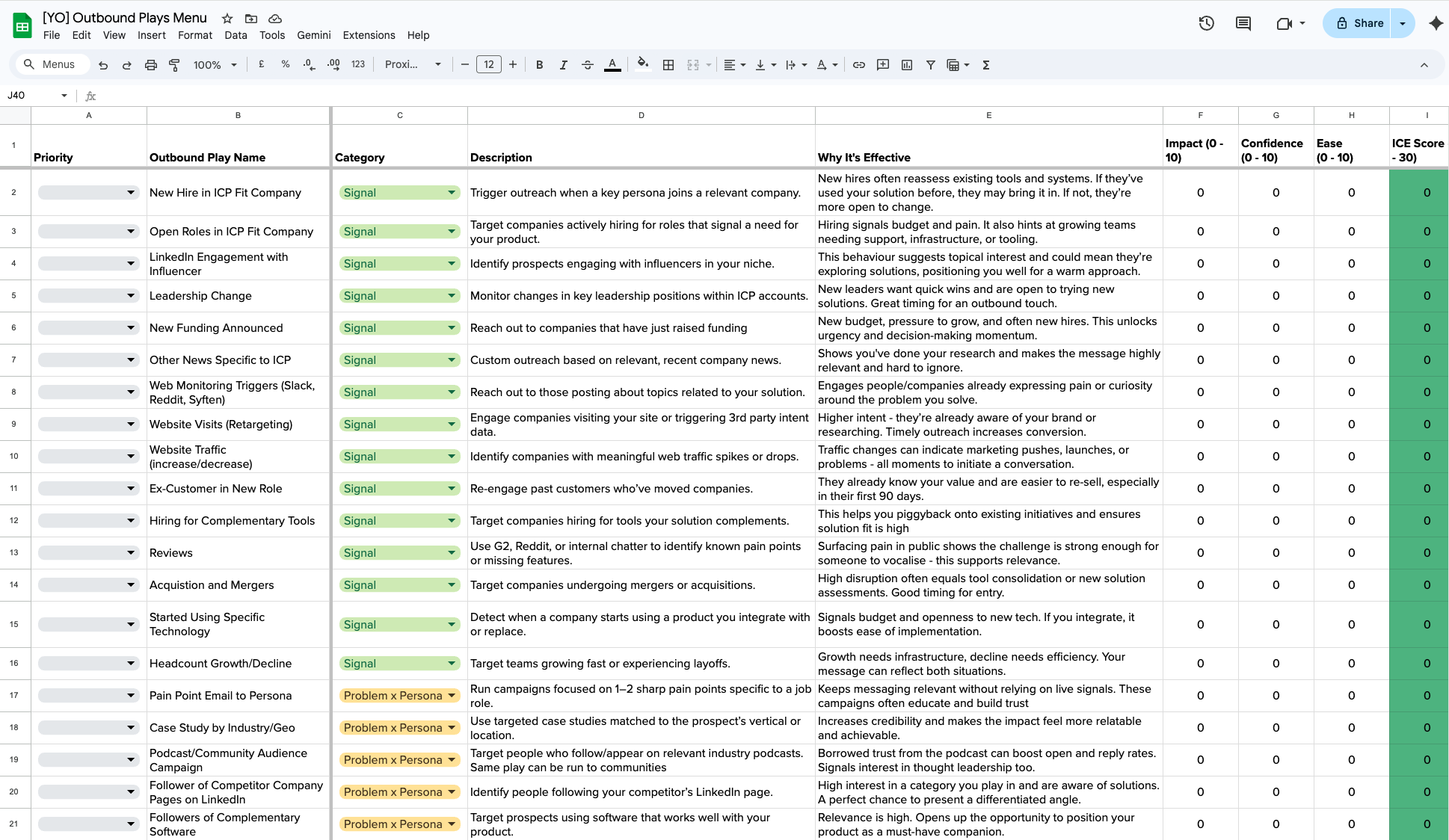

How I Prioritise Plays Using ICE Scoring

With clients, I keep a spreadsheet of outbound plays. We score each play using ICE so we can decide what to start with, what to run always-on, and what to deprioritise until later.

ICE Framework

- Impact: how likely the play is to generate a booked meeting or a strong positive reply

- Confidence: how confident we are it will work for your specific product, market, and motion

- Ease: how easy the data is to find, enrich, operationalise, and deploy into campaigns

The goal is not to find the perfect play. It is to pick the best next plays given your constraints, then iterate based on performance.

Why Ease Matters More Than People Think

Some plays look incredible on paper, but the data is hard to source reliably, the enrichment costs are high, or the activation is messy. In those cases, we might still run the play, but it is usually not what we start with.

Signal Tiers: How to Think About Volume Remotely Correctly

I typically think in tiers:

- Tier 1 signals: highest intent, closest to buying, often lower volume, best suited to manual or semi-manual outreach

- Tier 2 signals: still valuable, but slightly earlier, sometimes higher volume, often better for semi-automated campaigns

- No-signal majority: the 90 to 95 percent of your market that needs problem x persona outreach and marketing-driven reasons to engage

Signal stacking is where this gets powerful. If you can combine two signals, for example funding plus open roles, your relevance goes up and your conversion typically improves.

Mapping Plays to Buyer Awareness

I like to map plays to buyer awareness so we can prioritise the plays that sit closer to product aware prospects.

- Unaware: not aware of the problem

- Problem aware: aware of the problem but not actively evaluating solutions

- Solution aware: aware solutions exist and may be exploring categories

- Product aware: aware of your brand or already considering you

As a rule, prioritise the plays that sit closer to product aware. That is usually where intent is highest and time-to-meeting is shortest.

Outbound Plays Library

Below are the plays grouped into the three categories from the video. For each play, you will see what it is, when it works, when it does not, and practical notes for execution.

1) Signal-Based Plays (Demand Capture)

1. New hire in an ICP-fit company

- What: targeting individuals who have recently joined a company that matches your ICP and who match your buyer persona.

- When it works: new hires reassess tools, vendors, and processes, especially in their first 30 to 90 days. They are often open to change and looking for quick wins.

- When it does not: the new hire is not a relevant persona, or they have no influence on the area you solve.

- Notes: this is often a strong always-on play. Keep it running continuously and segment by persona and seniority.

2. Open roles in an ICP-fit company

- What: targeting companies hiring for roles that indicate budget, pain, growth, or an operational change connected to your solution.

- When it works: the role being hired directly relates to the problem you solve or the team you help improve.

- When it does not: the job titles are generic, the role is irrelevant, or the signal is too broad and creates noise.

- Notes: the more specialised and senior the role, the stronger the signal tends to be. Tie your message to what the hiring implies.

3. LinkedIn engagement with influencers in your niche

- What: identifying people engaging with niche creators who talk about the exact problems you solve.

- When it works: engagement is with micro-influencers or subject matter experts discussing specific pains, frameworks, or buying criteria in your category.

- When it does not: engagement is casual support, the influencer is too broad, or you treat likes as buying intent.

- Notes: treat this as a warm context marker, then qualify via enrichment and ICP fit.

4. LinkedIn engagement with competitor content

- What: targeting people engaging with competitor posts, announcements, or conversations.

- When it works: the competitor content indicates active evaluation or category interest.

- When it does not: competitor is too large, engagement is superficial, or your value proposition is not clearly differentiated.

- Notes: this often maps closer to solution aware or product aware, so it can be high priority if you can source the data reliably.

5. Leadership change

- What: targeting companies with a new leader in a relevant function.

- When it works: new leaders want early wins and are open to changing vendors or processes.

- When it does not: your message implies the previous leader failed, or you cannot credibly connect your solution to their new priorities.

- Notes: you can use both joins and departures as signals. The message must be careful and respectful.

6. New funding announced

- What: targeting companies that have raised funding recently.

- When it works: funding leads to hiring, growth initiatives, and more willingness to invest in new tools or services.

- When it does not: your target market does not raise funding, for example agencies, local businesses, or solopreneurs.

- Notes: combine with open roles for signal stacking whenever possible.

7. Other news specific to your ICP

- What: reaching out based on relevant company news, initiatives, launches, partnerships, or strategic shifts.

- When it works: the news has a clear connection to the problem you solve and you can make a specific, credible point.

- When it does not: the news is too generic or your personalisation looks obviously automated.

- Notes: this is best used as a personalisation layer inside a wider campaign, not always as a standalone play.

8. Web monitoring triggers (social listening)

- What: monitoring communities and forums for people actively discussing pains, evaluating vendors, or requesting recommendations.

- When it works: commercial categories where people publicly discuss tools, vendors, and workflows.

- When it does not: sensitive topics, or categories where buyers avoid public discussion.

- Notes: Slack communities, Reddit, and niche forums can be strong. Set keyword alerts and assign ownership.

9. Website visits (first-party or intent platforms)

- What: prioritising outreach to people who visited your website or showed intent signals via third-party platforms.

- When it works: you have meaningful traffic volume and a way to identify accounts or people reliably.

- When it does not: low traffic, poor identification, or long delays between visit and outreach.

- Notes: this is often a high priority always-on campaign if the inputs are strong.

10. Website traffic increase or decrease

- What: monitoring changes in a company’s website traffic as a proxy for launches, marketing pushes, or performance issues.

- When it works: your solution is connected to demand, growth, web performance, or marketing outcomes.

- When it does not: the traffic changes are unrelated to what you sell.

- Notes: use this as a conversation starter, not as hard proof of pain.

11. Ex-customer in a new role

- What: re-engaging previous customers who have moved to a new company.

- When it works: almost always, because trust and familiarity already exist, especially within their first 90 days.

- When it does not: the product fit is no longer relevant in their new environment.

- Notes: many companies underuse this play. It is one of the highest leverage, easiest wins when data is clean.

12. Hiring for complementary tools

- What: targeting companies investing in tools that complement your solution, suggesting ecosystem fit.

- When it works: the complementary tool is tightly linked to your use case and indicates maturity.

- When it does not: the complementary tool is ubiquitous, creating noise, or the signal indicates early-stage maturity that does not match your pricing.

- Notes: define maturity thresholds and avoid overly broad tools that appear everywhere.

13. Reviews and public complaints (G2, Reddit, forums)

- What: identifying pains or gaps publicly expressed in reviews or discussions.

- When it works: the pain is specific, recent, and clearly connected to your value.

- When it does not: the complaint is not something you solve, or you cannot reference it without sounding creepy.

- Notes: handle with care. Sometimes you use the insight to shape your message without quoting the review directly.

14. Acquisitions and mergers

- What: targeting companies involved in M&A, where change often triggers tool consolidation and new evaluations.

- When it works: your solution is connected to integration, consolidation, reporting, governance, enablement, or operational change.

- When it does not: the acquisition is irrelevant to your solution, or the integration timeline is long.

- Notes: timing matters. Early disruption can be chaotic, later phases can be more structured.

15. Started using specific technology

- What: detecting when a company starts using a tool you integrate with, complement, or replace.

- When it works: the technology choice indicates readiness and a clear integration or replacement path.

- When it does not: the technology is too common, or the signal does not correlate with buying intent.

- Notes: this works best when the integration is a strong wedge or the replacement pain is obvious.

16. Headcount growth or decline

- What: monitoring meaningful headcount changes as signals for growth needs or efficiency pressure.

- When it works: you can align your message to growth infrastructure or efficiency improvement.

- When it does not: headcount changes are small or unrelated to your category.

- Notes: define thresholds, for example greater than 20 percent year-on-year growth, and segment accordingly.

2) Problem x Persona Plays (Demand Generation)

These are the plays you run for the majority of your market where you do not have strong external signals. This is your always-on engine, but it only works when segmentation and messaging are sharp.

17. Pain point email to persona

- What: campaigns focused on one or two sharp pains for a specific role.

- When it works: strong persona clarity, clear language, clear outcomes, and tight segmentation.

- When it does not: generic messaging that tries to speak to everyone.

- Notes: this is often the default volume campaign. The quality comes from segmentation and positioning.

18. Case study by industry

- What: reaching out with case studies relevant to the prospect’s industry.

- When it works: the case study mirrors their context, constraints, and outcomes.

- When it does not: you send generic proof to everyone without relevance.

- Notes: keep lists tight and align the subject line and first sentence to industry language.

19. Case study by geography

- What: using case studies from the prospect’s region to increase relatability.

- When it works: regional nuance matters, for example market, regulation, hiring environment, or buyer expectations.

- When it does not: geography is irrelevant to the outcome and feels forced.

- Notes: this is especially useful when you work across multiple countries or regions.

20. Podcast audience campaign

- What: targeting listeners, followers, or participants in niche podcasts related to your problem space.

- When it works: niche shows with tight audiences where listening indicates genuine interest.

- When it does not: broad shows where the audience is too varied.

- Notes: if the podcast has a LinkedIn company page, scraping followers can be a practical list source.

21. Community audience campaign

- What: targeting members of relevant professional communities.

- When it works: communities where members actively discuss problems your solution addresses.

- When it does not: you cannot reliably identify members or roles, or you treat membership as high intent.

- Notes: some communities encourage members to list the community as an employer on LinkedIn. That can become a list-building shortcut, with caveats.

22. Followers of competitor company pages

- What: building lists from people who follow competitors on social platforms.

- When it works: competitors are niche and the audience strongly overlaps with your ICP.

- When it does not: competitors are huge, creating noise and poor fit.

- Notes: start with smaller competitors first, then expand once you validate results.

23. Followers of complementary software company pages

- What: targeting followers of tools adjacent to your solution.

- When it works: strong integration story and clear overlap in workflows.

- When it does not: following does not correlate with evaluation or usage.

- Notes: this is often more useful for list building than for prioritisation.

24. Tool-based campaigns

- What: tailoring outreach based on the tools a prospect already uses.

- When it works: you can speak to a known pain in that stack, reduce switching risk, or offer a clear integration benefit.

- When it does not: the tool is too common and does not meaningfully segment the audience.

- Notes: major competitor moves, like pricing changes, can turn this into a high-performing moment.

3) Marketing-Driven Plays (Excuses to Reach Out)

These plays give you reasons to re-engage, nurture, and create light-touch touchpoints that open conversations.

25. Product release campaign

- What: reaching out about a new feature or release.

- When it works: the release addresses a known objection, missing requirement, or stalled-deal reason.

- When it does not: the release is minor and the outreach feels self-centred.

- Notes: this relies on good CRM hygiene, especially tracking why deals were lost or stalled.

26. Event invite campaign

- What: inviting prospects to webinars, roundtables, breakfast sessions, or in-person events.

- When it works: the event is relevant, small enough to feel curated, and positioned as genuinely useful.

- When it does not: generic invites to large webinars with unclear value.

- Notes: in-person events often outperform webinars, especially when capped and well targeted.

27. Direct mail

- What: physical mail to a small list of high-value accounts.

- When it works: high ACV, tight list, strong creative execution, and clean logistics.

- When it does not: low ACV, large lists, or poor targeting.

- Notes: treat this as a premium play for tier-one accounts, not a mass tactic.

28. Industry event attendees

- What: following up with people attending events where category interest is high.

- When it works: you can source attendee or RSVP data and act quickly while the event is fresh.

- When it does not: data is unreliable or your outreach is slow and generic.

- Notes: a strong workaround is running side events around major conferences.

29. Industry report or content follow-up

- What: following up with people who engaged with a report, guide, or piece of content.

- When it works: content is genuinely relevant and you follow up with a clear next step.

- When it does not: content is generic and the follow-up has no purpose.

- Notes: keep this ongoing, not one-off.

30. Quiz or scorecard invite

- What: inviting prospects to complete a quiz or scorecard that diagnoses their current state.

- When it works: the scorecard is useful, the output is specific, and it naturally leads to a conversation.

- When it does not: it feels gimmicky or provides vague results.

- Notes: if you track responses well, you can use low scores to prioritise follow-up with context.

31. Newsletter subscriber re-engagement

- What: reaching out to newsletter subscribers as a warm list.

- When it works: you enrich the list, segment by ICP and persona, and use a light-touch approach.

- When it does not: you treat all subscribers the same and push for a call immediately.

- Notes: this is only relevant if you have an active newsletter list worth working.

32. Content download abandoners

- What: following up with people who started but did not complete a content download.

- When it works: you capture email early in a two-step form and follow up quickly.

- When it does not: you do not capture enough intent or you follow up too late.

- Notes: this is a process and tooling play as much as it is a messaging play.

33. Live chat inquiries

- What: following up with people who started a live chat but did not convert.

- When it works: you have their email and can follow up with speed and context.

- When it does not: the chat data is not routed properly or no one owns follow-up.

- Notes: many teams sit on this data. Turn it into a defined play with SLAs.

34. New analyst coverage campaign

- What: using analyst or review coverage to create credibility and a reason to talk.

- When it works: the coverage supports a clear narrative about trends and readiness.

- When it does not: it is framed as bragging rather than insight.

- Notes: co-created assets with analysts or review platforms can perform well when used thoughtfully.

35. Competitor pricing changes

- What: reacting to competitor pricing moves with a relevant alternative.

- When it works: the pricing move creates pain, uncertainty, or frustration, and you can offer a clear path.

- When it does not: you cannot credibly support switching, migration, or value comparison.

- Notes: these are rare but powerful moments. Be ready to act quickly.

36. Industry or regulation changes

- What: leveraging regulatory shifts or industry changes that force action.

- When it works: the regulation creates urgency and you can tie your solution directly to compliance or adaptation.

- When it does not: the regulation is too far out or your message is too vague.

- Notes: these are often once-in-a-decade opportunities. If you are relevant, lean in hard.

How to Use This in Your Own Outbound Programme

Step 1: Build your play library

Start by listing the plays above that are relevant to your ICP, personas, and motion. Do not try to run everything at once.

Step 2: Score plays using ICE

Score impact, confidence, and ease. Then rank them. Use this to decide where to start and what to keep always-on.

Step 3: Decide what is always-on versus manual

- Always-on: plays with reliable data and repeatable activation, often new hires, website visits, pain point persona campaigns

- Manual or semi-manual: low volume, high intent signals, especially when you can stack signals

Step 4: Operationalise and measure

Every play needs a defined workflow. Who owns it, how the list is built, how often it runs, how enrichment works, which sequences or talk tracks are used, and what success looks like.

Common Mistakes to Avoid

Treating signals as the entire strategy

A common mistake is building an outbound motion that relies almost entirely on signals. Signals are, by definition, scarce. Only a small percentage of your total addressable market will surface clear, usable signals at any given time. If your strategy depends on signals alone, you will cap your pipeline volume very quickly.

Signals should be used as a prioritisation layer, not the foundation of outbound. They help you decide where to apply more effort, more personalisation, and more senior attention. They do not replace the need for a consistent, scalable outbound engine that can reach the wider market.

Assuming a signal equals buying intent

Not all signals indicate readiness to buy. A LinkedIn like, a job post, or a website visit does not automatically mean someone is in market. Many signals indicate curiosity, education, or internal change rather than active evaluation.

When teams treat signals as proof of intent, they often push too hard too early. This leads to aggressive messaging, poor reply rates, and prospects disengaging. Signals should shape context and relevance, not force a premature sales conversation.

Poor segmentation on problem x persona campaigns

Problem x persona campaigns make up the majority of outbound activity, but they are often executed poorly. The most common issue is broad segmentation, where one message is sent to multiple roles, industries, or maturity levels.

When messaging is not tightly aligned to a specific persona and problem, it feels generic and easy to ignore. Strong problem x persona campaigns require discipline. One clear pain, one clear role, and one clear outcome. Anything broader reduces relevance and performance.

Choosing plays that look good but are hard to execute

Some outbound plays look great on paper but fall apart in practice. This usually comes down to data. The signal might be strong, but the data is unreliable, expensive to enrich, or difficult to operationalise consistently.

This is why ease is a critical part of prioritisation. A slightly weaker play that can be executed cleanly and repeatedly will almost always outperform a theoretically perfect play that is messy to run. Execution quality matters more than novelty.

Not adapting plays based on results

Outbound is not static. Markets change, buyer behaviour evolves, and what worked six months ago may stop working without warning. A major mistake is setting up plays and leaving them untouched.

Each play should be reviewed regularly. Look at reply quality, not just reply volume. Look at meeting conversion, not just opens. Plays should be refined, paused, or replaced based on real performance, not assumptions or trends.

What I Want You to Take Away

Signal-based prospecting is not a silver bullet

Signals are powerful, but they are not magic. They do not fix weak positioning, unclear ICPs, or poor messaging. Used correctly, signals help you prioritise effort and increase relevance. Used incorrectly, they become a distraction.

The strongest outbound programmes use signals as an overlay on top of solid fundamentals, not as a replacement for them.

Some signals are more effective for some companies than others

No signal is universally effective. The value of a signal depends on what you sell, who you sell to, your price point, and your sales motion. A signal that works extremely well for a B2B SaaS company may be almost useless for an agency or a consultant.

This is why copying plays without context often fails. Signals must be evaluated against your specific ICP, personas, and constraints.

You cannot rely on signals alone

The majority of your market will never surface obvious signals. If you want predictable pipeline, you must run demand generation plays alongside demand capture.

Problem x persona campaigns create awareness and start conversations where no signal exists. Marketing-driven plays provide reasons to re-engage and nurture. Signals help you prioritise, but they do not replace the need for volume, consistency, and segmentation.

What works for someone else does not automatically work for you

Outbound advice on LinkedIn often lacks context. A play shared publicly may be working because of a specific market, a specific audience, or a specific data advantage that is not visible from the outside.

The goal is not to copy tactics. The goal is to understand the principles behind them, then apply those principles to your own ICP, personas, and resources. Outbound works best when it is designed, tested, and adapted for your reality, not someone else’s highlight reel.

Want the Spreadsheet and a Custom Priority Plan?

If you want access to the spreadsheet and help identifying which plays make the most sense for your company, schedule a call with me here: yellowo.co.uk/schedule. I will share the sheet and walk you through which plays to prioritise based on your ICP, personas, and current data.